Auto Insurance in and around Upland

The Upland area's top choice for car insurance

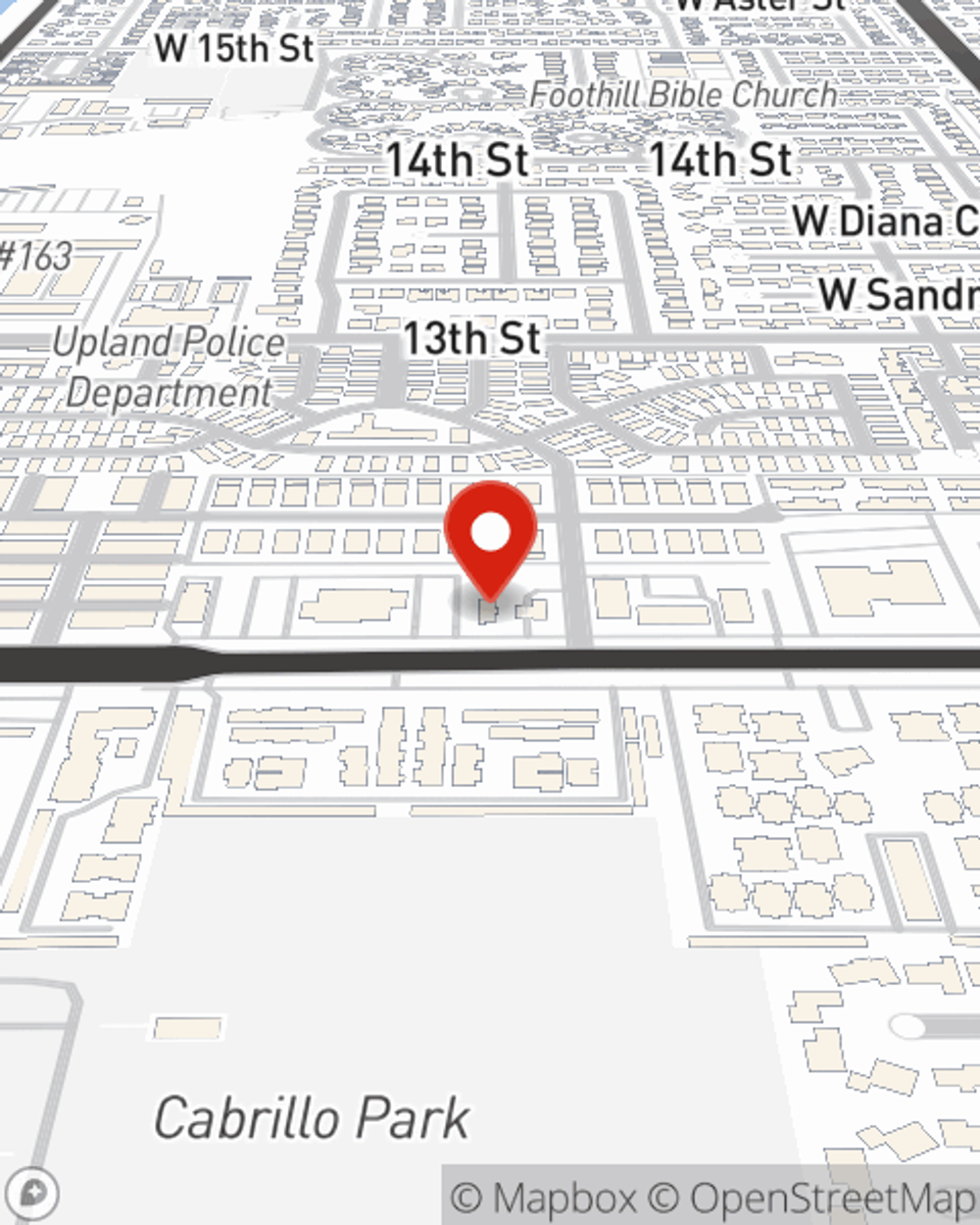

Take this route for your insurance needs

Would you like to create a personalized auto quote?

You've Got A Busy Schedule. Let Us Help!

Everyone knows that State Farm has outstanding auto insurance. From sedans to smart cars pickup trucks to SUVs, we offer a wide variety of coverages.

The Upland area's top choice for car insurance

Take this route for your insurance needs

Great Coverage For A Variety Of Vehicles

But there are lots of ways to get where you are going and move from Point A to Point B. State Farm also offers insurance for mini-bikes, go-carts, jet skis, dune buggies and snowmobiles. Whatever you drive, State Farm has you covered and stands ready to help with great savings options and attentive service. Plus, your coverage can be personalized, to include things like rideshare insurance and car rental insurance.

Want to learn more about the other options that may also be available to you? State Farm agent Joshua Marsh would love to walk through them with you and help you create a policy that fits your particular needs. Call or email Joshua Marsh to get started!

Have More Questions About Auto Insurance?

Call Joshua at (909) 458-0801 or visit our FAQ page.

Simple Insights®

Rest area safety tips

Rest area safety tips

Rest areas can be convenient places to take a break. Here’s some rest area safety tips for pulling over at highway rest stops.

What is full coverage auto insurance?

What is full coverage auto insurance?

Understand what full coverage auto insurance means. Learn about liability, collision and comprehensive coverage and find the right car insurance coverage for you.

Joshua Marsh

State Farm® Insurance AgentSimple Insights®

Rest area safety tips

Rest area safety tips

Rest areas can be convenient places to take a break. Here’s some rest area safety tips for pulling over at highway rest stops.

What is full coverage auto insurance?

What is full coverage auto insurance?

Understand what full coverage auto insurance means. Learn about liability, collision and comprehensive coverage and find the right car insurance coverage for you.